Let’s Do The Numbers

Welcome to our 7th Annual Land Report. The Land Group has completed another trip around the sun, and we are pleased to bring you our findings from another year working in the dirt. 2021 was to put it in basic terms, OUSTANDING!

The Company saw over 100% growth in two critical areas of our vital factors, that being Sales Volume and Total Transactions. These two categories grew by 117% and 125%, respectively. Additionally, the number of acres transacted grew by over 30% to 13,000 acres.

Broadly speaking, the land market is extremely strong and land values are experiencing measured increases except in small areas of the region where transitional land use is occurring around small towns and municipalities in the region. In these areas of land use change land values do exponentially change in value. Land-use change is a primary driving force for significant changes in land value historically, and this trend remains true. The impact of land-use change effects land values beyond the transitional areas as we can document a radiating impact in what the land buyer will pay when transitional lands are nearby. These markets have been arduous to evaluate in recent years as the land value in those markets near the coastal beach towns around the Delmarva or Southern Maryland areas are highly influenced by development. While we do not report development land sales as a data set in this report, transactional data demonstrates land values in this category can exceed $50,000 an acre for residential or commercial land use.

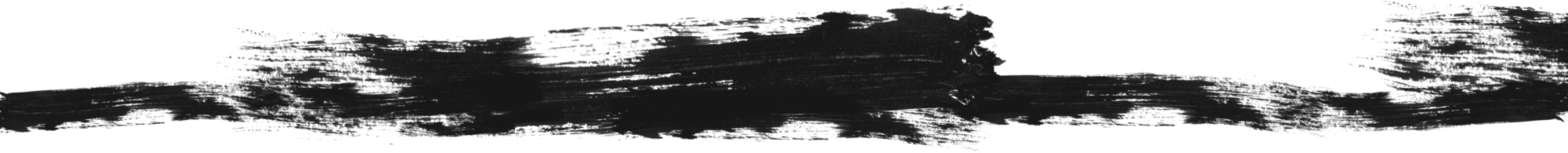

Farmland transactions are interesting to review as buyers vary widely their economics and criteria for land acquisition. In our review of land sales data, we studied over nearly 200 farmland sales and reported on 170 transactions for the last two-year period. Farmland as a product type is perhaps the most sought-after land commodity in the Chesapeake Region. Agricultural producers generally had a positive year due to a good growing season and increased commodity pricing. Together these two factors yielded good outcomes for farmers throughout the region. The celebration in the agricultural community is extremely muted however, due to increased input costs to the farm. These increased input costs to the farm operation are often blamed on supply chain issues and cost of natural resources throughout the world. While some of this may be true, many producers argue it is simply a response to the pricing of corn and there is no need to look or explain further. In any case, the agricultural sector continues to be the backbone of land ownership in the Chesapeake Region and production farming continues to become more competitive in each passing cycle. There seems to be no factor that will influence this trend otherwise. Average farmland values for high quality farmland in Maryland and Delaware reach nearly $10,000 per acre in in several counties.

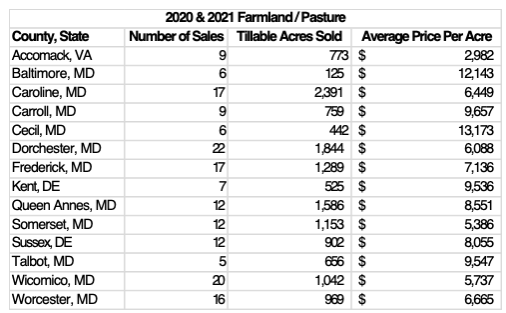

Timberland investors have seemed to return to the market in recent years, even as economics in the timber industry face difficult times with little to no margin in the operation of commercial timber mills. These economic forces have forced many commercial timber buyers out of the market in past decades. On the bright side, in 2021, we worked with several timberland buyers that from an investment perspective with much attention being given to the fiber resource. Additionally, on the Delmarva Peninsula, one sawmill was purchased and given new life, while another specialty mill was opened to focus on value ad wood products. The timber industry in the Chesapeake Region is critical to maintaining our economy and rural communities. These investments in the timber sector were positive signs and we see an upside in the future of timberland investing in the region as there has been a limited amount of commercial timber planting in recent decades as the industry has struggled. We remain optimistic that new investment and creative thinking by current industry leaders will create more value at the stump for the landowner. The Maryland Forest Association and other like-minded groups are working throughout the Chesapeake Region to support growth and investment in the timber industry and the work they are doing is clearly making a difference.

Recreational land buyers are the shining star of the land market in 2021, as the economic factors driving investments in these property types are nearly an index of the equity markets and track nearly in the same direction. Recreational timberland and farms managed primarily for wildlife have been driving this product type in the data, and in some cases, we have seen multiple offer situations and bidding for such highly sought-after properties. Hunting, fishing and outdoor recreation has witnessed a considerable bump in enthusiasm in recent years as we all look for opportunities for get outside and focus on “space and distance” considering the conditions established through the pandemic. This clearly has driven the economics of the wildlife land buyer. Evaluating these farms from a land value perspective are often challenging in that when breaking down the values achieved in these transactions, through the lens of tillable land, timberland, and marshland as components of the property, the value metrics are often exceeded on per acre analysis. These properties where high natural resource values are present and perceived by the market receive offers and sell for pricing that exceeds the value in the sum of its parts. Continuously, the data is witness to the value of these wildlife farms or wildlands and our reductionist approach to valuing these land tracts is often challenged. Sales for wildlife farms in the region have reached even $10,000 an acre for high quality hunting farms that are improved with waterfowl impoundments and managed intensely for deer and turkey. A clear trend in this product type is the diminishing interest in highly improved or finished luxury homes. As an asset, class luxury homes are clearly valuable but when mixed with the wildlife farm, they are often undervalued by the wildlife marketplace. The wildlife buyer over and over seeks high quality barns nicely equipped with workspace, ample storage and living space.

In closing, as we enter 2022, The Land Group is incredibly appreciative of all the support you have given us over the years, and we are working hard to advise you in all of your land goals now and in the future. The Land Report is one tool we work to provide you each year. Additionally, this year we have included two informational pieces on land investing along with the land analysis data from the past two years. We trust you will find it valuable, and we look forward to seeing you in the field. Be well.

The goal of this analysis is to use comparable sales data to calculate per-acre land values for farmland, and timberland in Maryland, Delaware, and Eastern Shore of Virginia. Our focus is on the counties where we are active participants in the land markets & have working knowledge of individual trades. This analysis doesn’t include properties containing significant improvements or entitlements. We set a minimum acreage per trade of 50 acres. Emphasis was placed on arms-length raw land trades occurring in 2020 and 2021.

- Maryland: Average tillable farmland values fall between $5,000 and $7,000 per acre for lower shore counties. Values on the upper shore come in between $6,500 and $9,500 per acres. Cleared land values on the Western Shore are significantly higher and highly depend on location.

- Delaware: Average farmland values fall between $8,000 and $9,500 per acre.

- Virginia: Average farmland values in Accomack County were roughly $3,000 per acre.

- Maryland: Average timberland values fall between $1,800 and $2,000 per acre on the lower shore. Wooded land values on the mid to upper shore range from $2,500 to over $5,500 per acre. Values on the Western Shore range from $2,000 to over $5,000 per acre and are highly dependent upon location.

- Delaware: Due to significant development pressure in Delaware, we see a major difference in the value of conserved timberland versus non-conserved timberland. Non-conserved timberland in DE is trading around $4,000 per acre, while conserved timberland is trading around $2,000 per acre.

- Virginia: Average wooded land values in Accomack County were roughly $1,000 per acre.

The 2021 real estate market for farmland and wooded land was strong. Several contributing factors include low interest rates, large amounts of liquidity in the market, and increased demand from buyers looking to escape urban areas. We have begun to see the effects of this increased demand along with low market inventory. As expected, the combination has resulted in rising land values across the region.

Data used in this analysis is based on information provided by county tax records, MLS data, and market knowledge provided by The Land Group. For more information about the analysis please contact Nick Campanaro of The Land Group at 443-465-3520 or [email protected].