What I learned in Vegas Did Not Stay in Vegas…

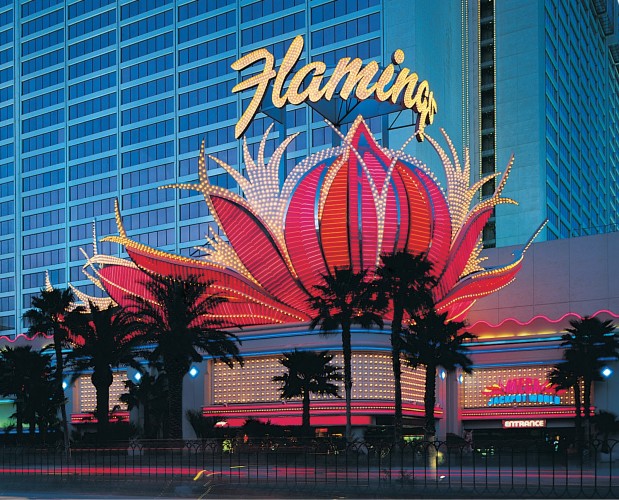

Last month I attended the Rural Land Institute’s (RLI) annual National Land Conference and fortunately for me I did not have to leave everything I learned in Vegas in Vegas! RLI’s annual event was held in Las Vegas this year a featured a wide array of talks and information for land professionals. RLI’s mission as part of the National Association of Realtors (NAR) is to support the development and improvement of the specialized knowledge base required in conducting land based real estate transactions. The NAR Code of Ethics requires professionals in the real estate industry to be experts in their field and RLI works to maintain the highest level of expertise for land professionals engaged in the practice. RLI accomplishes this mission through their Accredited Land Consultant designation and the LandU School through which they provide the industry’s premier source for land education. As a new member to RLI, I did not know what to expect from my first conference and the organization, but true to their mission RLI delivered a highly informative program with two full days of talks, work sessions, and networking breakouts.

The conference proved to be one of the largest conferences’s held to date and brought in over 200 Rural Land Institute Members and Accredited Land Consultants from throughout the US. The conference was attended by Steve Brown – President Elect of National Association of Realtors. He emphasized the inclusion of RLI’s mission and commercial real estate being brought into the NAR tent as everyone has a shared mission and benefits from this inclusion.

Conference highlights included talks from recognized economists Dr. Mark Dotzour of Texas A&M and KC Conway of Colliers International. It was highlighted that this is in spite of the brutal dis-function of Washington D.C. and the void of leadership the economy is showing a number of positive indicators of steady recovery. Dr. Dotzour supported this by stating primarily Americans are fatigued by the self created problems economic leaders continue to perpetuate, stating, they have “cried wolf” long enough. While this is not to belittle the serious challenges of current economic conditions which still remain, the consensus of these economists rests with the people’s resiliency to get back to business and they believe all signs are pointing in this direction.

Most metrics including residential home sales, retail, auto and the like suggest the five year pent up demand is starting to be realized. The numbers suggest this uptick started in 3Q of 2011. A critical factor in this recovery now well underway is the uncertainty is no longer as uncertain as tax rates are now in place, capital gain rates are established and the much debated new health care policy is finally now being understood and businesses are finding strategies through which they can comply with the new law and some indicators suggest the actual impact to businesses may not be “as bad” as once believed. While this “as bad” scenario is not very reassuring, the principal point, is the unknown is far more difficult to plan around and make sound business choices. These financial uncertainties until now have proved to be a hardened barrier to a true economic recovery.

As the recovery continues inflation starts to be a concern. According to Dr. Dotzour there are specific policies at the Fed’s disposal to control the infusion of this liquidity currently now in the banks from being released in amounts which may bring about the conditions needed for hyper-inflation. The indicator to watch for this to occur is when the Central Bank stops purchasing bonds and securities from banks and adding liquidity to the marketplace as this will ultimately cause interest rates to rise. It is hypothesized that this will not occur until the unemployment rate, comes below 6.5%. It is expected the current monetary policy of the Fed will remain static into 2014.

Land price sustainability was a key topic during the conference and this question clearly relates to the stability of interest rates as well. There were a range of opinions on this question of land price sustainability, especially as it relates to agricultural land in states like Iowa where prices have reached $20K an acre. To summarize, it comes down to basic analysis of income to the property versus carrying cost of the land. The confidence as an investor that you have in the sustainability of commodity prices, interest rates, agricultural input costs and agricultural production all weigh into this analysis. While there was some discussion of “froth in the ag-land” market in places like Iowa it was also pointed out that overall agricultural debt has continue to decrease on farm operation balance sheets and lending practices through the farm credit system continue to require significant down payments in-order to reduce risk related to financial leverage in the farm land market. Overall, ag-land where value is rooted in fundamentals of income and costs of ownership will continue to be good investment.

While nothing an economist says can be taken for gospel, nothing your other financial advisors can be as well. This is the best information I see coming from professionals working in the industry today and that is worth a cup of coffee. Maybe.